The United States Securities and Exchange Commission (SEC) has initiated legal action against Kraken, a prominent cryptocurrency exchange, accusing it of operating as an unregistered securities exchange, broker, dealer, and clearing agency. The SEC’s complaint, disclosed in a recent release, asserts that Kraken has been involved in the unlawful facilitation of buying and selling crypto asset securities since at least September 2018, generating hundreds of millions of dollars in the process.

The core contention in the SEC’s lawsuit is that Kraken, despite performing the functions of an exchange, broker, dealer, and clearing agency, has failed to register these operations with the SEC, as mandated by law. The SEC’s charges against Kraken encompass multiple facets:

- Operating as an Unregistered Exchange: The SEC argues that Kraken functions as an exchange, bringing together buyers and sellers to facilitate the trading of securities without the required registration.

- Brokerage Activities: The SEC alleges that Kraken engages in the business of effecting securities transactions for its customers, effectively operating as a broker without proper registration.

- Dealer Operations: Kraken is accused of buying and selling securities for its account without an applicable exception, thereby operating as a dealer without the necessary regulatory approvals.

- Clearing Agency Functions: The SEC contends that Kraken acts as an intermediary in settling transactions in crypto asset securities, serving as a securities depository and operating as a clearing agency, all without proper registration.

In addition to these charges, the SEC expresses concerns about Kraken’s handling of customer information. The lawsuit highlights the exchange’s purported risk to customers’ personal and financial data due to “poor recordkeeping” and questionable business practices. Specifically, the SEC claims that Kraken commingles customer funds with its own and pays operational expenses directly from accounts holding customer cash. This practice, along with mixing customers’ crypto assets with the exchange’s own, is said to pose a “significant risk of loss” to Kraken’s customers.

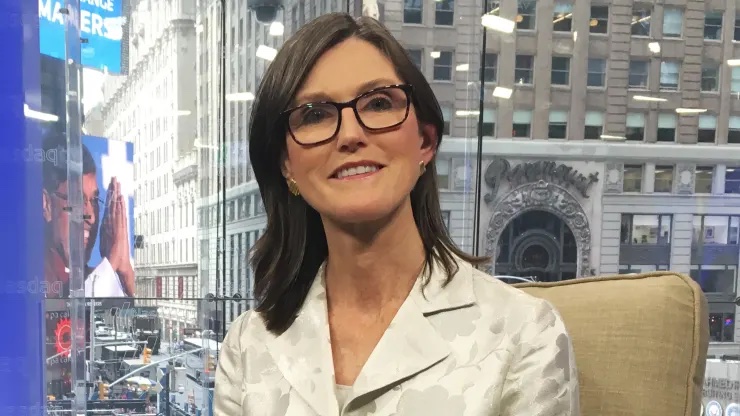

Gurbir S. Grewal, the director of the SEC’s Division of Enforcement, emphasized the regulator’s stance, stating that Kraken prioritized unlawful profits over compliance with securities laws, resulting in a business model with conflicts of interest that jeopardized investors’ funds. Grewal framed the legal action as a message to the broader industry, urging compliance with regulatory standards.

The SEC’s lawsuit follows Kraken’s earlier agreement this year to cease offering securities through crypto asset staking services and staking programs. As of now, Kraken has not issued a formal response to the SEC’s legal action. The lawsuit was filed in San Francisco, and the situation highlights the ongoing regulatory scrutiny faced by major players in the cryptocurrency industry.

[…] Kraken lawsuit mirrors past SEC actions, highlighting the regulator’s unsuccessful attempts to regulate the crypto industry. This […]