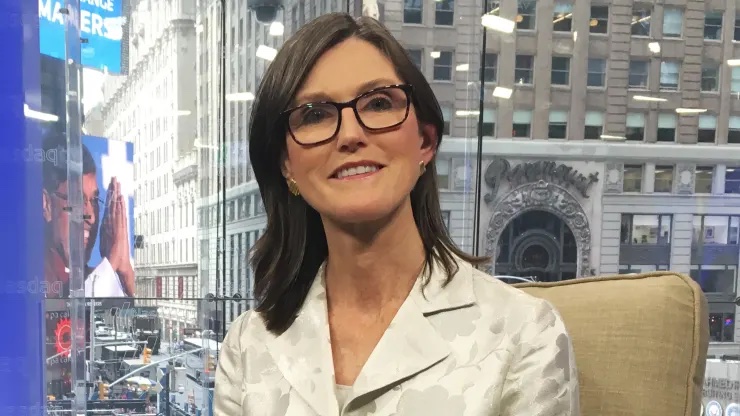

Cathie Wood’s Ark Invest resumes Coinbase shares sale. The strategic offloading spree saw 34,261 shares being sold, totaling $5.5 million from two funds as seen in the latest company filing.

This move follows last week’s disposition of $59 million worth of Coinbase shares, and $24.3 million the week before. Despite its recent surge, Coinbase stock remains 53% below its all-time high. Now trading at $161.16, the stock marks a 342% year-to-date surge. Coinbase’s current valuation still sits at $28.5 billion.

Coinbase’s Trajectory & Peaks

Coinbase stock continues its impressive trajectory, hitting a new yearly high. Despite the surge, it remains 53% below its all-time high of $343. Recent performance indicates a 66% increase over the past month. This contributes to the significant year-to-date growth and valuation.

Ark’s Robinhood Maneuver & Market Resilience

Ark Invest extends its strategic moves, selling 121,100 Robinhood shares. This is worth $1.6 million from its Fintech Innovation ETF. Prior to this, Ark purchased $3.3 million worth of HOOD shares. This strategic move comes ahead of Robinhood’s European crypto trading app launch.

Robinhood’s Market Trends & Expansion

Robinhood shares currently trade at $13.17, marking a 10% daily increase. Despite the positive trend, shares are still down approximately 76% from their peak. Robinhood’s European crypto trading app launch introduces over 25 coins and tokens. This includes popular cryptocurrencies like Bitcoin, Ether, and Solana.

Ark Invest resumes Coinbase & Robinhood shares sale

As Ark Invest tactically maneuvers through Coinbase and Robinhood stocks, strategic realignments persist. The recent share offloading and portfolio adjustments showcase Ark’s dynamic approach in an evolving market. In the next months, more movements are expected as the news related to cryptocurrency markets regulations see the light. Several investment funds and companies are delaying their decision based on the lack of clarity, a complaint that is being repeated since years ago.