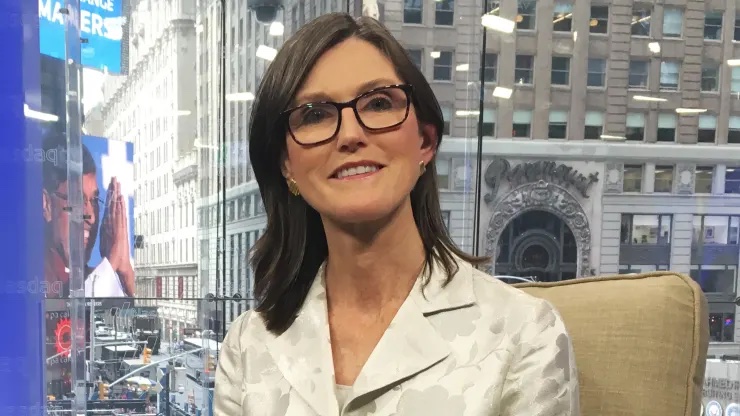

Ark Invest’s Continuous Sell-Off Journey

Ark Invest sells Coinbase stock, but not only that, as Cathie Wood’s company remains in the relentless process of also selling Grayscale Bitcoin Trust (GBTC) shares. The recent filing reveals the disposal of 180,422 COIN shares, equivalent to $24.3 million, and 99,595 GBTC shares, valued at $3.5 million.

Further Dissecting Coinbase Sales

Ark executed the sell-off across different funds, shedding 12,474 Coinbase shares ($1.7 million) from its Fintech Innovation ETF, 5,369 ($723,000) from its Next Generation Internet ETF, and a substantial 162,579 ($21.9 million) from its Innovation ETF. Adding this to the $33.3 million COIN offloaded on Tuesday and $1.4 million on Monday, the cumulative figure reaches a staggering $59 million in Coinbase shares liquidated this week.

Coinbase Stock Performance Amidst the Sell-Off

While the sell-off is underway, Coinbase stock closed at $134.63, showcasing a commendable 7% increase over the past week, a remarkable 55% surge over the past month, and an impressive 269% year-to-date, marking its highest level in 18 months.

GBTC Shares – Another Chapter in the Sell-Off Saga

Simultaneously, Ark Invest strategically divested 99,595 GBTC shares ($3.5 million) from its Next Generation Internet fund on Wednesday. This move follows the 168,127 GBTC shares ($5.9 million) offloaded from the same ETF the previous day. GBTC shares concluded the day at $34.92, experiencing a 14% gain in the last week, a 28% upswing over the past month, and an extraordinary 325% surge year-to-date.

Riding the Bitcoin Wave: GBTC’s Link to Bitcoin’s Surge

The surge in GBTC’s value aligns with Bitcoin’s recent upswing. Bitcoin, presently trading at around $43,302, witnessed a robust performance with a 16% increase over the last seven days, a 25% climb in the past month, and an impressive 166% surge year-to-date.

What’s next after Ark Invest sells Coinbase stock

Ark Invest’s continuous adjustments in its crypto holdings underscore the dynamic nature of the market. This reflects a steadfast commitment to strategic portfolio management amidst ever-evolving market conditions.