In the Asian session, Bitcoin started an aggressive move downwards, that triggered a cascade of crypto long liquidations. Inadvertently, Bitcoin reached nearly $40,000 from a weekly high of $43,800, marking a nearly 9% decline. Concurrently, Ethereum faced a matching drop to $2,165 at the time of writing.

Impact on Crypto Long Liquidations

The downturn triggered a substantial surge in liquidating long positions on centralized exchanges. Over $94 million in bitcoin positions underwent liquidation, with a significant portion, $85 million, originating from longs. The overall crypto market witnessed a total of $450 million in liquidating long positions, contributing to a staggering $530 million in liquidations across various exchanges. Within the past 24 hours, more than 130,166 traders faced liquidation, as seen in CoinGlass.

Derivatives Market Dynamics: Reduction in Demand

Within the derivatives market, traders grappled with liquidations when their positions were forcibly closed due to insufficient funds. Funding rates for bitcoin, ether, and other cryptocurrencies dipped below +0.01%, contrasting with the over +0.1% observed in recent weeks. This indicates a reduced demand for leveraged longs, as per CoinGlass data.

Surge in DeFi Liquidations: On-Chain Retail Leverage

Founder of data provider Parsec, Will Sheehan, observed a surge in DeFi liquidations at around $2 million. He highlighted that it’s the first time in over a year that “retail has been getting leveraged on-chain.”

This is the first time in months that retail gets more and more comfortable having long positions opened, and the result is now seen.

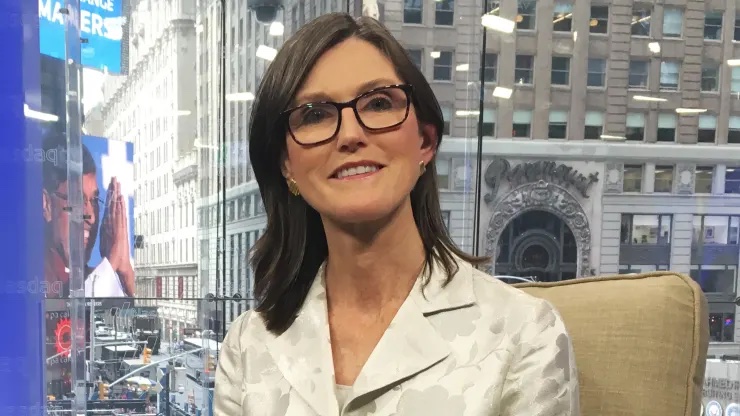

Analysts’ Positive Outlook: Bitcoin’s Future Predictions

Despite the recent market fluctuations, experts at investment management firm VanEck maintain a positive outlook on cryptocurrency. They predict Bitcoin will attain new all-time highs by the fourth quarter of 2024. This optimism stems from expectations surrounding the upcoming Bitcoin halving event and the potential launch of a spot bitcoin exchange-traded fund.